With healthcare expenses climbing, managing employee health insurance costs is becoming increasingly challenging.

Additionally, the high-risk industries present their own unique set of challenges — workers’ safety and well-being depend on comprehensive coverage, which adds up to the final employer’s health insurance costs.

So, the ultimate question on everyone’s mind is, “How much do employers pay for health insurance?”

In this article, we’ll discuss the factors that affect employee insurance expenses and some essential strategies that can help you reduce these costs while still providing the vital coverage your team needs.

How Much Does It Cost Employers to Provide Health Insurance?

When it comes to figuring out how much employee health insurance costs, it’s helpful to start with the big picture.

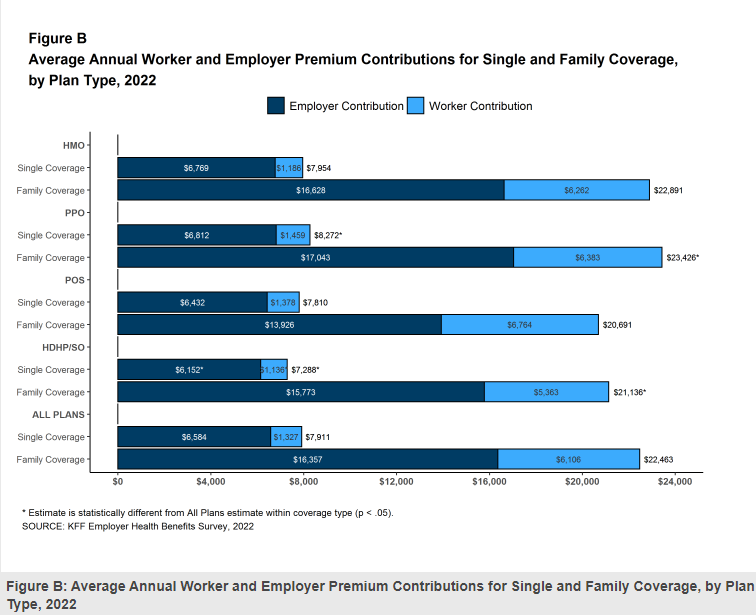

In 2023, the average employee health insurance cost was $8,431 for single coverage and $23,968 for family coverage. This amounts to an average employer health insurance cost of about $15,000 per employee – an 8.5% increase in just 1 year.

Please note: These numbers can vary significantly based on the size of the business, the location, and the specific plan details.

So, how much does health insurance cost per employee in high-risk industries?

In fields like construction, mining, and transportation, the costs can easily exceed the national average. For instance, the construction industry saw a premium increase of 10.1% in 2022, which surpassed inflation rates.

Factors That Impact Health Insurance Costs

Several factors come into play when it comes to the cost for companies to offer health insurance:

- The age, health status, and risk profile of employees: Older workers or those with pre-existing health conditions might lead to higher costs because they’re more likely to need medical care. And let’s face it, working in a high-risk industry means employees are more prone to injuries, which also pushes up insurance rates.

- The type of coverage: More comprehensive plans with lower deductibles and broader networks generally come with a higher price tag. But that’s often the trade-off for ensuring workers get the care they need.

- The company size: Larger companies might benefit from economies of scale, allowing them to negotiate better rates, while smaller businesses often face higher per-employee costs.

- The company’s claims history: A higher number of claims, particularly related to the cost of workplace injuries, can lead to increased rates as insurers adjust for the perceived risk.

Tax Implications of Employer-Sponsored Health Insurance

When providing health insurance to employees, there are some important tax implications that can significantly impact your bottom line.

One of the biggest advantages is that employer contributions to health insurance premiums are typically tax-deductible as a business expense, leading to considerable savings.

For your employees, the benefits are usually tax-free, meaning the portion of the premium you pay isn’t considered taxable income. This is a big plus for them, as it reduces their overall tax liability.

Now, depending on the type of health insurance plan you offer, the tax implications can vary. If you go with a fully insured plan, where you pay a fixed premium to an insurance provider, your tax treatment is straightforward—deduct the premiums as a business expense.

However, if you opt for a self-insured plan, where you cover the healthcare costs directly, the situation gets a bit more complex. While you can still deduct the amounts paid out for claims, you might also face additional taxes and fees, such as those associated with the Affordable Care Act.

Innovative Approaches to Reducing Employee Health Insurance Costs

Managing employee medical insurance costs is a challenge. But with a bit of creativity and the right strategies, it’s possible to keep these costs in check without sacrificing the well-being of your workforce.

Let’s explore 5 great strategies that can make a real difference.

1. Implementing Preventive Health and Safety Programs

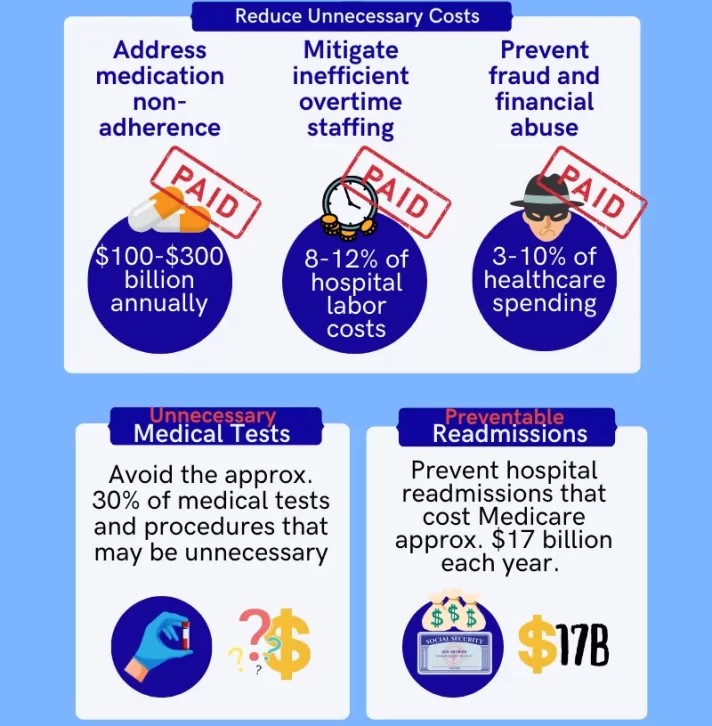

Preventive health and safety programs are a proactive approach that can save your company money in the long run. Think about it—if you can reduce the number of injuries and health issues on the job, you’ll likely see a drop in your insurance premiums as well.

For example, regular health screenings can catch issues before they become serious while providing effective training programs enhances workplace safety and helps prevent injuries.

Wellness programs that address health risks, such as musculoskeletal problems or respiratory issues, are also crucial. These initiatives don’t just create a healthier workforce—the ROI on employee health and wellness programs can directly contribute to lower insurance costs by reducing the frequency and severity of claims.

If you’re considering incorporating such injury management services into your employee health plans, start small. Introduce regular health check-ups, offer incentives for participation in wellness activities, and ensure that safety training is part of every project.

2. Leveraging Risk Management Solutions for Workers Comp Insurance

Integrating risk management solutions for workers’ comp insurance is another powerful strategy. Introducing onsite healthcare options, such as on-site medics, ensures immediate care and reduces emergency visits.

For example, having on-site medical professionals allows you to handle injuries and health concerns immediately, reducing the need for expensive emergency room visits. Similarly, using telemedicine for workplace safety provides your workers with quick access to medical advice and treatment, which can prevent minor issues from becoming major problems.

To make this work, it’s important to collaborate closely with your insurance provider and healthcare partners. Set up a clear plan for managing injuries on-site and ensure that everyone understands the process. Over time, you’ll likely see a reduction in claims, which can lead to lower premiums.

3. Utilizing Union-Negotiated Health Plans

If your company works with unionized labor, union-negotiated health plans can offer significant cost advantages. These plans benefit from collective bargaining, which often results in better rates and more comprehensive coverage due to the pooling of resources.

Working with unions to secure these plans can be a smart move, but it requires maintaining a strong, cooperative relationship. When negotiating, focus on finding agreements that meet both your budgetary needs and the union’s goals for worker coverage. By doing so, you can ensure that you’re getting the best possible deal for your employees and your company.

4. Exploring Alternative Funding Options

Alternative funding models, like self-insurance and level-funded plans, are worth exploring as well.

In a self-insured plan, your company takes on the risk of paying for employee health claims directly rather than paying a fixed premium to an insurer.

Level-funded plans, on the other hand, combine elements of both fully insured and self-insured models, offering more predictable costs while allowing for potential savings if claims are low.

These options can be particularly appealing to companies that are looking for more control over their health insurance costs. However, they do come with risks, so it’s important to carefully evaluate whether these models are right for your company’s size and risk profile.

5. Adopting Technology for Cost Management

Digital health tools, telemedicine, and wearable devices can all play a role in keeping your workforce healthy and your costs down.

For example, wearable devices that monitor heart rate, movement, and other vital signs can help improve workplace safety. Telemedicine offers quick, cost-effective access to healthcare, reducing the need for in-person visits. This can help you lower insurance premiums by reducing claims and improving overall employee health.

For starters, you can pilot a program with a small group of employees and measure the impact on both health outcomes and costs. As you gather data, you can expand the program to include more workers and further reduce your health insurance expenses.

Addressing Common Challenges in High-Risk Injury Industries

With the unique risks workers face every day, finding ways to manage costs while providing the necessary coverage is no easy task.

Let’s break down the common challenges they encounter and explore some practical solutions.

Managing High-Risk Workers and Pre-Existing Conditions

It’s common to have employees who are more susceptible to injuries or who have underlying health issues. This can drive up premiums, making it harder to keep costs under control.

To address these safety issues in the workplace, you can implement tailored wellness programs focused on injury prevention, managing chronic conditions, and promoting overall health.

Another strategy is to explore risk-sharing agreements, where both the employer and insurer share the financial risk of high-cost claims. This can help spread out the costs and make premiums more manageable over time.

Balancing Cost with Comprehensive Coverage

Striking the right balance between comprehensive coverage and controlling costs is a constant challenge. In high-risk industries, where injuries and job-specific health risks like respiratory issues are common, skimping on coverage isn’t an option. But at the same time, you need to keep your budgets in check.

The key here is to prioritize the coverage options that matter most. Focus on the risks that are most relevant to your workforce.

For instance, ensuring that your plan covers injuries and respiratory issues should be a top priority. You might also consider offering supplemental coverage options for employees who want or need more comprehensive protection. This allows you to provide essential coverage while giving workers the choice to tailor their benefits to their individual needs.

Dealing with Seasonal and Temporary Workers

Seasonal and temporary workers are just as exposed to the risks of the job as full-time employees but offering them the same level of coverage can be financially challenging.

One solution is to explore short-term health plans that offer basic coverage during the time these workers are on-site. These plans can be more affordable than traditional health insurance and still provide necessary protection for their employment.

Another option is to offer voluntary benefits, where workers can opt into coverage that meets their specific needs. This might include accident insurance, critical illness coverage, or other targeted benefits that address the unique risks they face on the job.

Lastly, if you’re working with unionized labor, see if there’s a way to leverage union agreements to extend coverage to seasonal and temporary workers. Sometimes, unions have negotiated benefits that can be extended to these workers, offering a more cost-effective way to ensure they’re protected.

Conclusion

From implementing preventive health programs to leveraging alternative funding models, there are various ways in which you can reduce employee health insurance costs. Also, proactively managing your health insurance plan is key to keeping it both affordable and effective.

At JobsSiteCare, we bring long-running expertise in telehealth, on-site safety and health solutions, and workers’ comp insurance to help you navigate these challenges. If you’re looking for expert support in managing your health insurance and worker safety, we’re here to keep your workforce protected.

Take the next step by taking our risk assessment quiz, or contact us to learn more about how we can support your business.

Frequently Asked Questions

What Does Having 80/20 Coverage Mean?

80/20 coverage means your insurance pays 80% of covered medical expenses while you’re responsible for the remaining 20%. This typically applies after you’ve met your deductible.

Can You Deduct Employer Health Insurance Premiums on Taxes?

Yes, employer health insurance premiums are generally tax-deductible as a business expense, which can provide significant savings.

Is the Cost of Employee Health Insurance Worth it?

Absolutely. Providing health insurance can improve employee satisfaction, reduce turnover, and enhance productivity, making it a worthwhile investment for your business.